How do the EU’s VAT rules impact Amazon sellers?

On July 1, 2021 the EU changed the VAT rules for businesses selling into the bloc. In the past, items priced below 22 Euros were VAT exempt, but these items are not subject to VAT at the border if shipped from a ‘third country’ such as the US, China and the UK.

The VAT changes also include changes on higher value items, moving away from the distance selling threshold model used previously. These changes do have the potential to cause customer disruption due to unexpected VAT charges being levied on the customer at the border.

To help businesses and sole traders manage the VAT process, the EU launched two new schemes – IOSS and OSS.

Here we look at how the EU’s VAT changes affect Amazon sellers and how they can use the new VAT schemes.

What is the IOSS Scheme and how does it apply to Amazon sellers?

The new Import One Stop Shop (IOSS) scheme has been designed for businesses without a registered office in the EU, meaning the sellers can collect, declare and pay the correct VAT without the customer being charged.

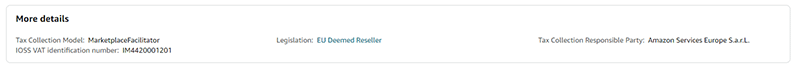

For sellers on online marketplaces such as Amazon the rules are slightly different. The EU now classifies them as a deemed supplier, meaning it is Amazon’s responsibility to get the VAT correct.

This is great news for Amazon sellers as – by registering for the IOSS scheme – the entire VAT collection and payment process is simplified as it is effectively managed by Amazon.

Despite this, there are some steps Amazon sellers need to follow when making sales using the IOSS scheme:

How to be IOSS compliant when making sales on Amazon

When an EU customer buys your product on Amazon, your list price will remain the same but the European VAT will be added at the checkout stage. This means that you won’t lose any VAT but Amazon will add and collect it instead.

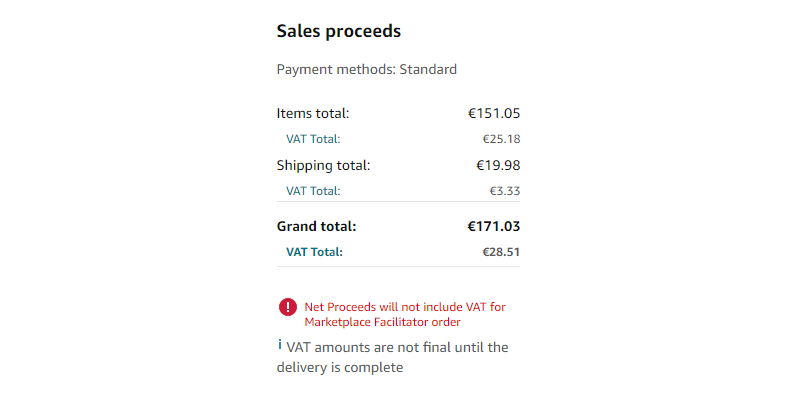

In this example below, a sale of EUR 112.96 to France would be EUR 22.60 of VAT to be paid by the customer. Previously, the Amazon seller was paid the VAT in their payouts, but Amazon will instead retain the VAT and pay the EU country on your behalf.

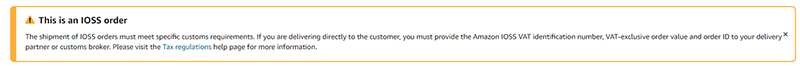

After you make a sale on Amazon to a customer in the EU, Amazon will highlight it as an IOSS order on Amazon Seller Central to make you aware of the requirements for shipping the parcel.

How to include Amazon’s IOSS Number on your shipping documents

After the sale has been made, you will also need to include Amazon’s IOSS number on your parcels to allow for it to pass through customs without any issues.

Amazon provide the IOSS number on the order details page, which you will need to include on the customs form itself.

You are required to put the IOSS number on the customs form under the Tax Schemes/VAT Reg/EORI number section.

Many delivery suppliers with Amazon integrations will automatically include the IOSS number on the delivery info section, but it’s best to check this does not need to be done manually.

It’s important to note these rules only apply to fulfilled by merchant sellers, for FBA sellers there are a different set of rules.

Amazon FBA Sellers need to apply for the one-stop shop (OSS) scheme

For Fulfilled by Amazon (FBA) sellers, the rules are slightly different. This is because FBA items are housed in warehouses within the buyer’s market, in this case within the EU.

This means that the seller still needs to register for VAT in the country where you store your items using the new One Stop Shop (OSS) scheme instead of IOSS.

The new OSS scheme means merchants report sales in an EU country where their stock is held with VAT charges also collected in that country.

Don’t get caught out by the new EU VAT rules

Although the new regulations can seem a scary proposition at first, with the potential for unhappy customers faced with unexpected VAT charges, over time they should actually simplify the VAT collection process in the EU for Amazon sellers.

If you are still unsure, speak to a specialist Amazon accountant who can guide you in the right direction.