Mastering the Weighted Average Cost Method for ecommerce

Inventory management is a critical aspect of running a successful ecommerce business.

It involves the acquisition, storage, and distribution of goods, with the goal of ensuring that products are available when customers need them while minimizing costs and optimizing profits.

One of the most fundamental aspects of inventory management is inventory costing, which is simply assigning a value to the products held in stock.

There are three inventory valuation methods that are widely regarded as the best for accounting records:

- FIFO (first-in, first-out)

- LIFO (last-in, first-out)

- Average cost method (sometimes shortened as WAVCO or AVCO, which all essentially mean the same thing)

The average cost inventory method is a widely used inventory costing method that provides a middle ground between the more complex first-in, first-out (FIFO) and last-in, first-out (LIFO) methods.

During times of inflation, the cost of goods sold under LIFO tends to come out the highest because it reflects the most recent purchases, while the cost of goods sold under FIFO tends to come out the lowest because it assumes that older, cheaper inventory is sold first.

In contrast, AVCO uses a weighted average, resulting in costs that fall somewhere in between.

Weighted average cost per unit = total cost of goods available for sale ($) / quantity of goods available for sale (units)

In this blog post, we will explore the concept of average cost inventory management, its advantages and limitations, and how it can benefit ecommerce businesses.

Let’s get started!

What is the average cost method (AVCO)?

The average cost method is an inventory valuation method that calculates the cost of goods sold (COGS) and the value of the ending inventory by averaging the costs of all units in stock.

Under this method, the total cost of all units in stock is divided by the total number of units to determine the average cost per unit. This average cost is then used to value the cost of goods sold and ending inventory.

The average cost method can be used in both perpetual and periodic inventory systems. In a perpetual inventory system, inventory levels are continuously updated, and each sale and purchase is recorded as it occurs.

In a periodic inventory system, inventory levels are only updated periodically, usually at the end of a reporting period.

How do inventory valuation methods actually work?

The average costing method is just another form of inventory valuation. And inventory valuation is simply calculating the value of the goods held by your business that you intend to sell to generate revenue.

The two essential formulas that all inventory valuation methods start with is:

Opening inventory + additional inventory purchases = total cost of goods available for sale

Total cost of goods available for sale – COGS (cost of goods sold) = closing inventory value

This closing inventory value is the true value of your inventory at the end of a given accounting period (it’s also called your ending inventory).

It’s important to remember that when you make a sale, you not only earn revenue but also incur a cost, and the inventory cost flow assumptions help estimate what that cost should be.

These are things that drastically affect your balance sheet and income statement, so it’s critical to understand the process of how they’re calculated.

Not to overwhelm you with formulas, but the final one you need to know is for AVCO itself:

Weighted average cost per unit = total cost of goods available for sale ($) / quantity of goods available for sale (units)

What is the value of using the average cost method for ecommerce businesses?

The average cost method can be very useful for ecommerce businesses for several reasons.

First, it allows businesses to determine their average inventory cost for a given period. This information is essential for financial planning and decision-making, as it enables businesses to understand the average cost of each unit in their inventory.

As mentioned above, the weighted average inventory cost is often a more accurate reflection of the true cost of goods sold than other inventory costing methods, such as FIFO or LIFO.

This is because the weighted average inventory cost takes into account the cost of all inventory items, not just the most recently purchased or oldest items.

Using the average cost method also allows businesses to calculate the weighted average unit cost for their inventory.

This is calculated by dividing the total cost of goods available for sale by the total number of units available for sale.

The weighted average unit cost is important because it can help businesses make informed decisions about pricing, as well as determine profitability.

(If you’re not a math person, stick with us. We’ll go through a step-by-step process of calculating AVCO in the next section.)

Moreover, the average cost method is an invaluable tool for tracking sales revenue. By accurately determining the cost of goods sold, businesses can calculate gross profit, which is found by subtracting the cost of goods sold from the total sales revenue.

This can help ecommerce businesses make informed decisions about pricing, marketing, and inventory management.

Weighted average cost vs. simple average cost

Before we get into the weeds of calculating AVCO, we need to stop and define two terms: weighted average cost and simple average cost.

While both methods are used to calculate the average cost of inventory items, they differ in the way they calculate this cost and the scenarios in which they are most useful.

Weighted average cost method

The weighted average cost method is calculated by dividing the total cost of goods available for sale by the total number of units available for sale.

This method takes into account the varying costs of inventory items and assigns a weight to each item based on its cost.

For example, an item that costs $5 would have a higher weight than an item that costs $3, resulting in a weighted average cost that is closer to $5.

This method is useful when the cost of goods varies significantly over time or when a business deals with many different products at varying prices.

Simple average cost method

On the other hand, the simple average cost method is calculated by dividing the total cost of goods available for sale by the total number of units available for sale, without taking into account the varying costs of each item.

This method assumes that all inventory items have the same cost and assigns an average value to each item, resulting in a simple average cost that is the same for all items.

This method is useful when the cost of goods does not vary significantly over time or when a business deals with a small number of products that have similar costs.

What’s the difference?

Here’s the main difference between the two methods: the weighted average cost method takes into account the varying costs of inventory items, while the simple average cost method assumes that all inventory items have the same cost.

Therefore, the weighted average cost method provides a more accurate reflection of the true cost of goods sold, but may be more complicated to calculate.

The simple average cost method, on the other hand, is easier to calculate, but may not provide an accurate reflection of the true cost of goods sold.

Ultimately, the method that is right for a business depends on the nature of their inventory and the level of accuracy they require in their cost calculations.

If a business deals with a wide range of products at varying prices, the weighted average cost method may be more suitable. However, if a business deals with a small number of products with similar costs, the simple average cost method may be more appropriate.

For our purposes, we want the most figures possible, so we’ll be sticking with the weighted average method for the remainder of this blog post, and for almost all cases, we recommend you do the same.

And don’t worry, thanks to things like spreadsheets and inventory management software, you won’t have to be doing any mental math.

A four-step process to calculating AVCO

The four-step process for calculating the weighted average cost (AVCO) involves creating an inventory cost flow table, entering the known data, filling in the blanks, and calculating the total cost of goods sold and the closing inventory.

Let’s walk through these step-by-step, and then go back over them with a hypothetical example:

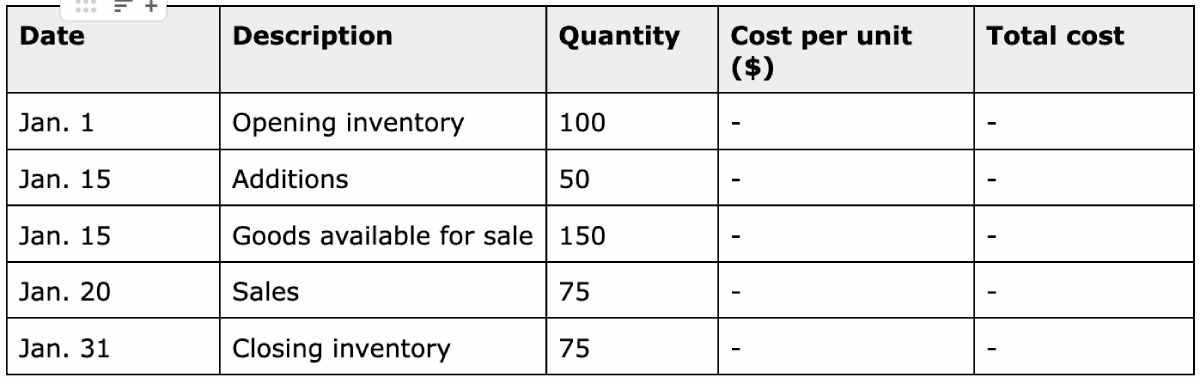

Step 1: Create an inventory cost flow table

The inventory cost flow table is a five-column table that tracks the inventory transactions of a business.

The columns are Date, Description, Quantity, Cost per unit, and Total cost. This table helps to visualize how the inventory costs flow through a business.

Here’s an example inventory cost flow table for a business that sells books.

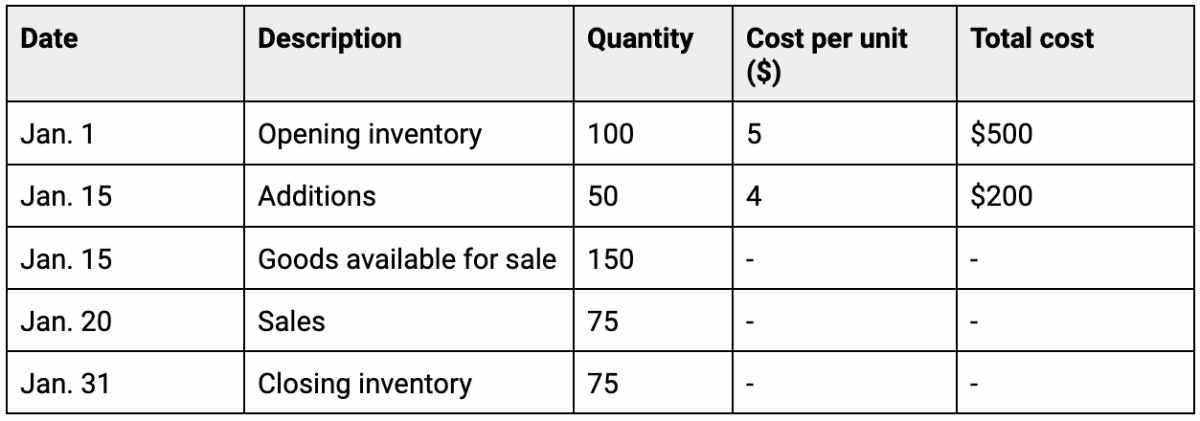

Step 2: Enter the known data

The known data includes the opening inventory, additions, and sales. The opening inventory is the quantity of goods held by the business at the beginning of the period.

Additions are purchases made during the period, while sales are the quantity of goods sold during the period.

In our example, the business started the period with 100 books in its inventory, which cost $5 each, for a total of $500. On January 15th, the business purchased 50 more books for a total cost of $200. On January 20th, the business sold 75 books.

Step 3: Fill in the blanks

Anyone who’s played a round of Sudoku knows the more blanks you fill in, the easier the solution to the puzzle becomes. Your inventory cost flow table is not unlike a more profitable (or more expensive, depending on the health of your business) game of Sudoku.

The blank spaces in the inventory cost flow table are filled in by calculating the cost of the opening inventory, the cost per unit of the additions, the total cost of goods available for sale, and the weighted average cost per unit of the goods available for sale.

To calculate the cost of goods available for sale in our example, we add the cost of the opening inventory to the cost of the additions ($500 + $200 = $700).

To calculate the quantity of goods available for sale, we add the opening inventory to the additions (100 + 50 = 150).

The weighted average cost per unit is calculated by dividing the total cost of goods available for sale by the quantity of goods available for sale ($700 / 150 = $4.67 per unit).

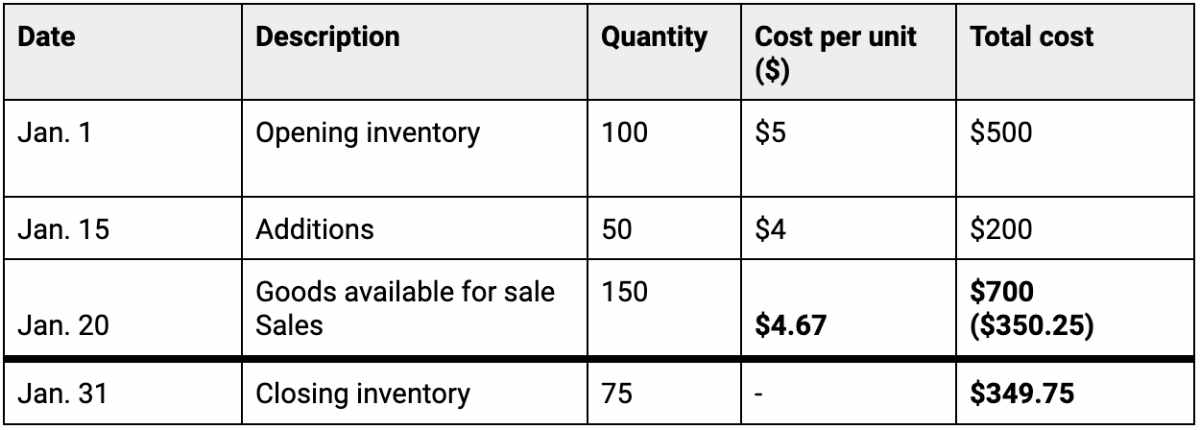

Step 4: Calculate the total cost of goods sold and closing inventory

The total cost of goods sold is calculated by multiplying the quantity of goods sold by the weighted average cost per unit. The closing inventory is calculated by subtracting the cost of goods sold from the cost of goods available for sale.

To calculate the cost of goods sold, we multiply the quantity of goods sold by the weighted average cost per unit (75 * $4.67 = $350.25).

To calculate the closing inventory value, we subtract the cost of goods sold from the cost of goods available for sale ($700 – $350.25 = $349.75).

Here’s our completed table (formatted according to accounting best practices):

By following these four steps, a business can use the weighted average cost method to determine the cost of goods sold and the value of closing inventory.

Final thoughts

We know this can be confusing, especially if you don’t have a background in accounting.

By practicing the steps of the process on your own, you can become more confident in your understanding of AVCO and gain greater control over your inventory management.

Additionally, don’t be afraid to consult with a professional accountant or financial advisor to ensure that you’re using the appropriate accounting methods for your business.

With time and practice, you’ll be able to accurately calculate your cost of goods sold and closing inventory using the weighted average cost method, which can help you make more informed business decisions and achieve long-term success.

Linnworks is an ecommerce software that offers a suite of tools to help businesses manage their inventory and accounting more efficiently.

One of its key features is its ability to integrate with accounting software such as QuickBooks, Xero, and Sage, allowing businesses to automatically sync their inventory data with their accounting system.

This means that any changes made to inventory, such as sales or returns, are automatically reflected in the accounting system, reducing the risk of errors and ensuring that the financial records are always up-to-date.